Too often we define the Medtech sector by the number of dollars raised, IPOs helped or companies sold. But the focus neglects the very foundation of the sector: the people. Join the Medtech Talk Podcast each month to hear from entrepreneurs, investors and executives who spend their days developing the tools that make sick people well and health care more efficient.

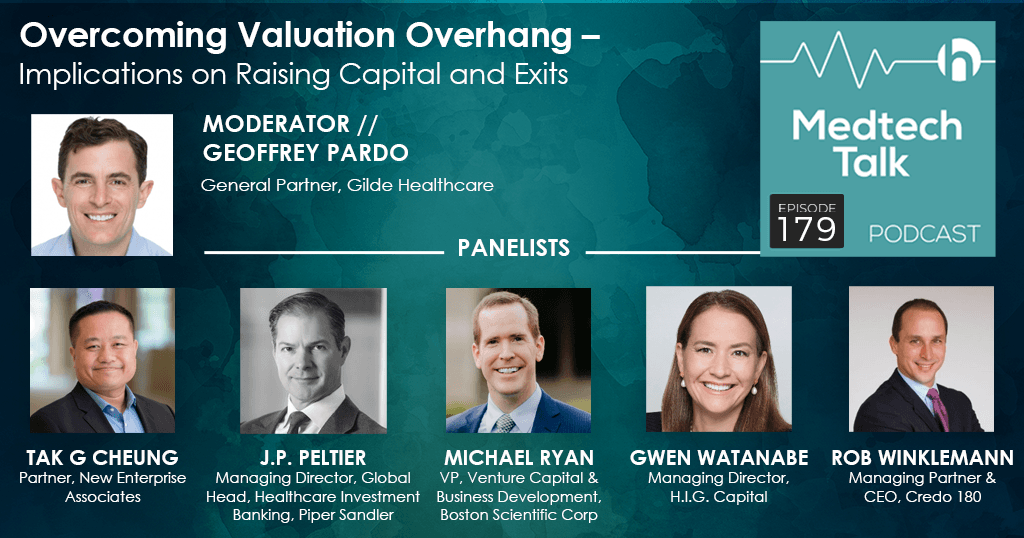

How has the bullishness of 2016-2022 impacted public markets and private companies? In this special episode of Medtech Talk, we share Geoff Pardo’s Medtech MVP 2023 panel, featuring Tak G Cheung, Partner at New Enterprise Associates; J.P. Peltier, Managing Director of Global Head, Healthcare Investment Banking at Piper Sandler; Michael Ryan, VP of Venture Capital & Business Development at Boston Scientific Corp; Gwen Watanabe, Managing Director at H.I.G. Capital; and Rob Winklemann, Managing Partner & CEO at Credo 180. The panelists discuss the implications for private companies, particularly those that were financed during the boom times, as well as strategies for keeping private companies financed, and the outlook for liquidity via M&A or IPO.

GUEST BIOs

Tak G Cheung, Partner, New Enterprise Associates

Tak joined NEA in 2018 and is currently a Partner on the healthcare team. He focuses on medical device investments. Prior to NEA, Tak was a Venture Partner at Merieux Development Venture Fund where he led all phases of investment for healthcare startups, including sourcing, diligence and investment approvals. Tak also co-founded Lexington Medical, a commercial-stage medical device startup in the gastrointestinal surgery space. Prior to Merieux and Lexington, Tak was VP of Business Development for the Global Surgical Division at Bausch & Lomb and was responsible for all business development efforts in the ophthalmic surgical division. Tak has held various corporate and business development leadership roles at Edwards Lifesciences in the Heart Valve Therapy Division and Advanced Medical Optics (acquired by Johnson & Johnson). Tak received a BS with Honors in Engineering and Applied Science from the California Institute of Technology, an MD from the University of California, Irvine, and an MBA from Harvard Business School.

J.P. Peltier, Managing Director, Global Head, Healthcare Investment Banking, Piper Sandler

J.P. Peltier is a managing director and head of healthcare investment banking at Piper Sandler. Peltier has more than 25 years of healthcare investment banking experience at Piper Sandler. He leads a global team of more than 130 healthcare investment banking professionals in offices across the U.S., Europe, and Asia. Peltier has extensive experience advising clients on mergers and acquisitions, public and private equity options, and other strategic alternatives. Peltier’s prior experience includes five years at HomeServices of America, a Berkshire Hathaway subsidiary, where he served as vice president of corporate development and president of the mortgage banking division. Peltier graduated from the University of St. Thomas and received a Master of Business Administration degree from the J.L. Kellogg School of Management at Northwestern University.

Michael Ryan, VP, Venture Capital & Business Development, Boston Scientific Corp

Michael Ryan leads the Venture Capital team for Boston Scientific, and also leads M&A/Business Development for the company’s MedSurg businesses (Endoscopy, Urology, and Neuromodulation). Since 2010, he has identified and closed over 60 transactions, including M&A deals totaling over $7B, and over $250M in VC investments. Michael has held a variety of corporate strategy, business development, and integration roles at Boston Scientific. Previously, he was VP Corporate Strategy and Business Development at Pulmonx, and a Senior Consultant at DRG, where he led case teams advising pharmaceutical and biotech clients. He has held voting and observer seats on the board of directors of a variety of public and private medical device companies. Michael holds a B.A. in Molecular Biology from Cornell University.

Gwen Watanabe, Managing Director, H.I.G. Capital

Gwen is a Managing Director of H.I.G. BioHealth Partners, focusing on investment opportunities in the life sciences sector, including biopharmaceuticals, health care IT, medical devices, and diagnostics. Gwen has been active in the life sciences sector for more than 28 years. Previously, she served as the General Manager and Vice President of US Robotics for Smith and Nephew and as the Corporate Vice President of Global Corporate Development, Strategy and Strategic Relationships at Teleflex, where for eight years she presided over all global acquisitions. Gwen joined Teleflex as a result of Teleflex’s acquisition of Hotspur Technologies, a company Gwen co-founded and served as President and Chief Executive Officer. Gwen was also a co-founder of Nellix Endovascular, Bacchus Vascular, and AneuRx, all three of which were medical device companies later acquired by larger strategic players. In addition, Gwen has been general partner of several private equity entities. Gwen currently serves on the board of Compute Health and is an observer on the board of Augmedics. Gwen holds an MS in Mechanical Engineering from Stanford University, as well as an MBA from Harvard Business School. She also holds a BS in Mechanical Engineering from the Massachusetts Institute of Technology where she simultaneously completed her pre-med requirements.

Rob Winklemann, Managing Partner & CEO, Credo 180

Rob has spent over 30 years in the capital markets, including debt advisory, corporate finance, and venture lending. He founded Credo 180 in 2006. Previously, Rob started the West Coast operations for two venture lending institutions including Charter Financial (acquired by Wells Fargo) and Oxford Finance Corporation. Before moving into the venture capital arena, Rob worked at LaSalle National Bank/ABN AMRO in Chicago providing senior secured debt, tax-exempt bond financings, and other structured finance vehicles to private, public and not-for-profit hospital systems & health care entities. Rob advises clients on growth capital financings for private and public life sciences companies, as well as late stage, sponsor driven buyout financings for healthcare companies. Rob earned his BSBA in Finance from Washington University St Louis and completed his MBA at the J.L. Kellogg Graduate School of Management at Northwestern University, with an emphasis in entrepreneurship and marketing. When not helping his clients finance the next break through, Rob spends most of his time fly fishing, skiing, or at the ice rink watching his son’s hockey team.